Coal Prices: Latest Price, Pricing, News, Market Analysis, Historical And Forecast, Database, Chart

| Report Features | Details |

| Product Name | Coal |

| Region/Countries Covered |

|

| Currency | US$ (Data can also be provided in local currency) |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Request for Real Time Coal Prices: https://www.procurementresource.com/resource-center/coal-price-trends/pricerequest

Coal is a sedimentary deposit made up of carbon and hydrocarbons that have been crushed, hardened, chemically changed, and metamorphosed over a period of millions of years.

It is a fossil fuel that is not renewable and is used to produce energy. The planet's crust is mined for it utilising the mining or surface mining technique.

Coal is extremely flammable and appears to be either black or brownish-black in colour. It lacks a fixed chemical makeup or crystal structure. With a density of between 1.1 and about 1.5 megagrams per cubic metre, it is denser than water.

Excellent reflectivity and qualities like grade ability, hardness, free swelling index, and ash fusion temperature are among their physical attributes.

The top producers of coal are China, India, Indonesia, the United States of America, and Australia.

Key Details About the Coal Price Trend:

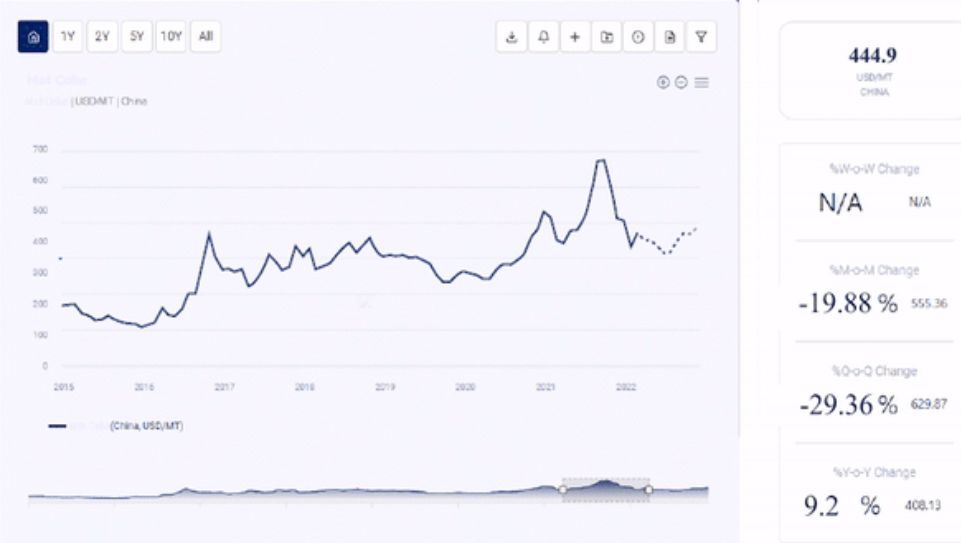

Procurement Resource does an in-depth analysis of the price trend to bring forth the monthly, quarterly, half-yearly, and yearly information on the Coal price in its latest pricing dashboard. The detailed assessment deeply explores the facts about the product, price change over the weeks, months, and years, key players, industrial uses, and drivers propelling the market and price trends.

Each price record is linked to an easy-to-use graphing device dated back to 2014, which offers a series of functionalities; customization of price currencies and units and downloading of price information as excel files that can be used offline.

The Coal price chart, pricing database, and analysis can prove valuable for procurement managers, directors, and decision-makers to build up their strongly backed-up strategic insights to attain progress and profitability in the business.

Industrial Uses Impacting Coal Price Trend:

Coal is extensively used in the generation of heat and electricity and hence, forms a pivotal requirement across almost all the industries. Coal finds its heavy direct/indirect applications across the energy sector around the globe.

Coal is extensively used in the generation of heat and electricity and hence, forms a pivotal requirement across almost all the industries. Coal finds its heavy direct/indirect applications across the energy sector around the globe.

It is a cheap source of fuel for electricity that is utilised in both households and businesses to complete a variety of tasks, which is increasing market demand.

Other than that, it is strongly reliant on the type of fossil fuel utilised for energy in the iron and steel industry, which increases market demand.

Additionally, it is used in the production of essential commodities including coal gas, tar, and coke. The demand for gas blanketing and refineries is also increasing in the chemical industry, which promotes market growth.

Key Market Players:

- BHP Group Limited

- China Shenhua Energy Co. Ltd

- Anglo American Plc

- China Coal Energy Co. Ltd.

- Arch Coal Inc.

- Coal India Ltd.

- Glencore Plc

- JSC Siberian Coal Energy Co.

News and Events:

- February 08, 2023: The Punjab Electricity Utility PSPCL has been urged by the power ministry to begin importing 15-20% of its domestic coal needs using the rail-ship-rail mode, despite the fact that transporting dry fuel would be less expensive than doing so. In a letter to Punjab State Power Corporation Ltd (PSPCL), the ministry said that while transporting fossil fuel through rail-ship-rail (RSR) is more expensive than all other rail routes, it is still less expensive than importing coal.

Related Reports:

- Cocoa Butter Price Trend - https://www.procurementresource.com/resource-center/cocoa-butter-price-trends

- Coffee Price Trend - https://www.procurementresource.com/resource-center/coffee-price-trends

- Coking Coal Price Trend - https://www.procurementresource.com/resource-center/coking-coal-price-trends

About Us:

Procurement Resource offers in-depth research on product pricing and market insights for more than 500 chemicals, commodities, and utilities updated daily, weekly, monthly, and annually. It is a cost-effective, one-stop solution for all your market research requirements, irrespective of which part of the value chain you represent.

We have a team of highly experienced analysts who perform comprehensive research to deliver our clients the newest and most up-to-date market reports, cost models, price analysis, benchmarking, and category insights, which help in streamlining the procurement process for our clientele. Our team track the prices and production costs of a wide variety of goods and commodities, hence, providing you with the latest and consistent data.

To get real-time facts and insights to help our customers, we work with a varied range of procurement teams across industries. At Procurement Resource, we support our clients, with up-to-date and pioneering practices in the industry, to understand procurement methods, supply chain, and industry trends, so that they can build strategies to achieve maximum growth.

Contact Us:

Company Name: Procurement Resource

Contact Person: Jolie Alexa

Email: sales@procurementresource.com

Toll Free Number: USA & Canada – Phone no: +1 307 363 1045 | UK – Phone no: +44 7537 132103 | Asia-Pacific (APAC) – Phone no: +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA

Comments

Post a Comment