| Report Features | Details |

| Product Name | Rice |

| Region/Countries Covered |

|

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Request for Real Time Rice Prices: https://www.procurementresource.com/resource-center/rice-price-trends/pricerequest

Rice is made from the seed of the grasses Oryza sativa, also referred to as Asian rice, or the less popular Oryza galberrima (African rice). More than half of the world's population, particularly in Asia and Africa, eats domesticated rice as their main staple food. This agricultural commodity has the third-highest global output after corn and sugarcane. It provides more than one-fifth of all the calories consumed by people worldwide. Rice is the most important food crop in terms of human nutrition and calorie consumption.Rice is a starchy seed derived from the grass Oryza sativa. Due to the lengthy amounts of water it needs to mature, it is more likely to be grown in areas with low rainfall. In America, it is an extremely labor-intensive plant to develop and is grown on moist, low terrain that may be openly owed. After corn and sugarcane, rice comes on third place in terms of production.

The largest producer of rice is India, followed by Thailand, Vietnam, Pakistan, the United States, China, Burma, and Cambodia.

Key Details About the Rice Price Trend:

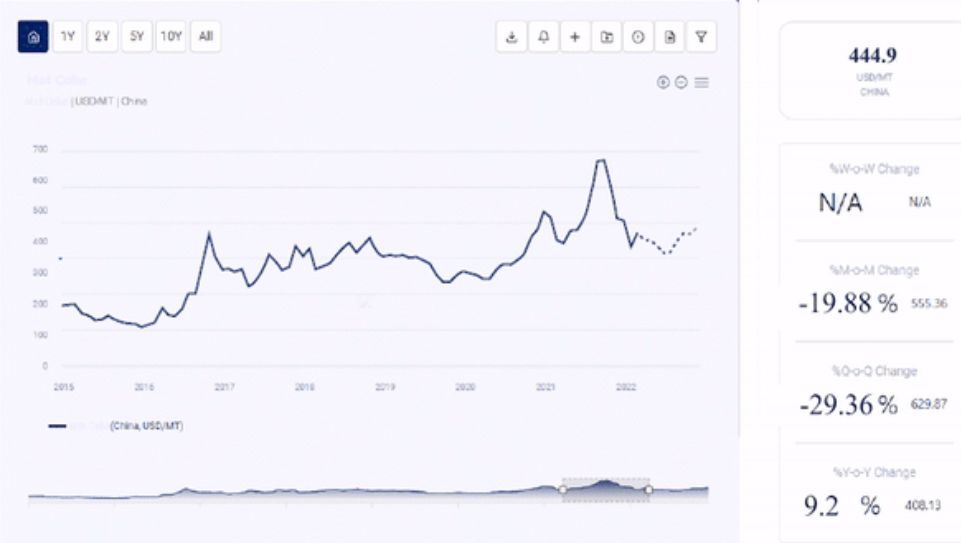

Procurement Resource does an in-depth analysis of the price trend to bring forth the monthly, quarterly, half-yearly, and yearly information on the Rice price, steel price, soybean price, etc. in its latest pricing dashboard. The detailed assessment deeply explores the facts about the product, price change over the weeks, months, and years, key players, industrial uses, and drivers propelling the market and price trends.

Each price record is linked to an easy-to-use graphing device dated back to 2014, which offers a series of functionalities; customization of price currencies and units and downloading of price information as excel files that can be used offline.

The Rice price trend, pricing database, and analysis can prove valuable for the procurement managers, directors, and decision-makers to build up their strongly backed up strategic insights to attain progress and profitability in the business.

Industrial Uses Impacting Rice Price Trend:

The primary factors influencing rice price trends are human consumption and a number of additional industrial uses. Livestock can be fed on the milled byproducts of rice, such as finely powdered bran and starch. Its oil can be further refined for use in both food and industry. Brewing, distilling, and creating starch and rice four all require broken rice. Rice hull can be used for packing, fertiliser production, industrial grinding, and fuel.

The primary factors influencing rice price trends are human consumption and a number of additional industrial uses. Livestock can be fed on the milled byproducts of rice, such as finely powdered bran and starch. Its oil can be further refined for use in both food and industry. Brewing, distilling, and creating starch and rice four all require broken rice. Rice hull can be used for packing, fertiliser production, industrial grinding, and fuel.

Key Market Players:

• DuPont de Nemours, Inc

• Cargill, Incorporated

• Wilmar International Ltd

• Doguet’s Rice Milling Company

• Randall Organic Rice

News and Events:

- • September 23, 2022: The Saginaw Chippewa Indian Tribe is starting an effort to restore wild rice, according to the EGLE director who visited Tawas Lake.

- • September 21, 2022: Following the limits established at the beginning of the month by the world's largest grain exporter, there are now considerations in place in order to allow the previously stalled foreign rice exports in India.

Related Reports:

- Refined Sunflower Oil Price Trend - https://www.procurementresource.com/resource-center/refined-sunflower-oil-price-trends

- Reformate Price Trend - https://www.procurementresource.com/resource-center/reformate-price-trends

- Rhenium Price Trend - https://www.procurementresource.com/resource-center/rhenium-price-trends

About Us:

Procurement Resource offers in-depth research on product pricing and market insights for more than 500 chemicals, commodities, and utilities updated daily, weekly, monthly, and annually. It is a cost-effective, one-stop solution for all your market research requirements, irrespective of which part of the value chain you represent.

We have a team of highly experienced analysts who perform comprehensive research to deliver our clients the newest and up-to-date market reports, cost models, price analysis, benchmarking, and category insights, which help in streamlining the procurement process for our clientele. Our team track the prices and production costs of a wide variety of goods and commodities, hence, providing you with the latest and consistent data.

To get real-time facts and insights to help our customers, we work with a varied range of procurement teams across industries. At Procurement Resource, we support our clients, with up-to-date and pioneering practices in the industry, to understand procurement methods, supply chain, and industry trends, so that they can build strategies to achieve maximum growth.

Contact Us:

Company Name: Procurement Resource

Contact Person: Jolie Alexa

Email: sales@procurementresource.com

Toll Free Number: USA & Canada - Phone no: +1 307 363 1045 | UK - Phone no: +44 7537 132103 | Asia-Pacific (APAC) - Phone no: +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA