Chloroprene is a combustible and carcinogenic chlorinated hydrocarbon, which is colourless and ethereal. Chloroprene is a chemical intermediate that is employed in the manufacture of neoprene rubber. The structural formula of chloroprene is C4H4CL, and its molecular weight is 88.53 g/mol. It is also referred to as 2-chlorobuta-1,3 diene.

Request for Real Time Chloroprene Prices: https://www.procurementresource.com/resource-center/chloroprene-price-trends/pricerequest

The CAS number of chloroprene is 126-99-8. A dimer, mono-vinyl acetate, which is composed of acetylene is reacted with a hydrochloric acid chloride and gives dichloroallene. Further, the arrangement of this intermediate gives chloroprene.

The leading exporters in the chloroprene market are Japan, the United States, Germany, South Korea, and Malaysia. On the other hand, the key importers of chloroprene are Indonesia, the Netherlands, and Sri Lanka.

Key Details About the Chloroprene Price Trend:

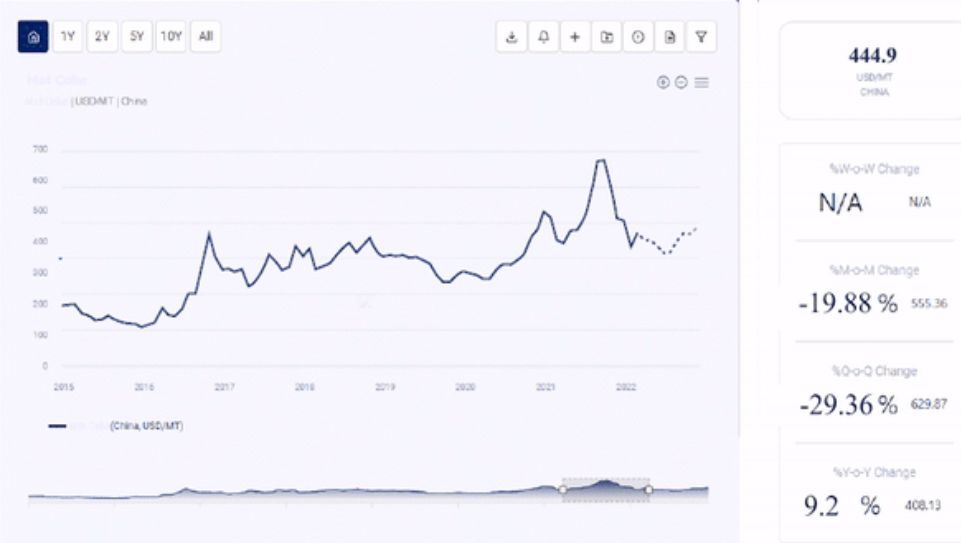

Procurement Resource does an in-depth analysis of the price trend to bring forth the monthly, quarterly, half-yearly, and yearly information on the chloroprene price in its latest pricing dashboard. The detailed assessment deeply explores the facts about the product, price change over the weeks, months, and years, key players, industrial uses, and drivers propelling the market and price trends.

Each price record is linked to an easy-to-use graphing device dated back to 2014, which offers a series of functionalities; customization of price currencies and units and downloading of price information as excel files that can be used offline.

The Chloroprene price trend, pricing database, and analysis can prove valuable for procurement managers, directors, and decision-makers to build up their strongly backed-up strategic insights to attain progress and profitability in the business.

Industrial Uses Impacting Chloroprene Price Trend:

There are several uses for chloroprene in the industrial sector that influence the price trend such as in the rubber industry which includes cables, conveyor belts, transmission, and moulded goods. It is also primarily used in the production of polychloroprene, hot-melt adhesives, and in automotive industry.

Key Players:

- Tosoh Corp.

- Denka Company Ltd.

- ARLANXEO

- Sedo Chemicals Neoprene GmbH

- Qingdao Nova Rubber

News and Events:

- August 24, 2022: Under the latest business plan, the company Tosoh corporation expanded the capacity of the chloroprene rubber. The company has invested Yen 200 billion to expand improving earnings and production capacity.

Related Reports:

- Chloromethane Price Trend - https://www.procurementresource.com/resource-center/chloromethane-price-trends

- Chloroform Price Trend - https://www.procurementresource.com/resource-center/chloroform-price-trends

- Chloroprene Rubber Price Trend - https://www.procurementresource.com/resource-center/chloroprene-rubber-price-trends

About Us:

Procurement Resource offers in-depth research on product pricing and market insights for more than 500 chemicals, commodities, and utilities updated daily, weekly, monthly, and annually. It is a cost-effective, one-stop solution for all your market research requirements, irrespective of which part of the value chain you represent.

We have a team of highly experienced analysts who perform comprehensive research to deliver our clients the newest and most up-to-date market reports, cost models, price analysis, benchmarking, and category insights, which help in streamlining the procurement process for our clientele. Our team track the prices and production costs of a wide variety of goods and commodities, hence, providing you with the latest and consistent data.

To get real-time facts and insights to help our customers, we work with a varied range of procurement teams across industries. At Procurement Resource, we support our clients, with up-to-date and pioneering practices in the industry, to understand procurement methods, supply chain, and industry trends, so that they can build strategies to achieve maximum growth.

Contact Us:

Company Name: Procurement Resource

Contact Person: Jolie Alexa

Email: sales@procurementresource.com

Toll Free Number: USA & Canada - Phone no: +1 307 363 1045 | UK - Phone no: +44 7537 132103 | Asia-Pacific (APAC) - Phone no: +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA

Chloroform, a colorless liquid with a distinct sweet odor, has had historical industrial applications. It was used as an anesthetic in medical procedures, although its use for this purpose has largely diminished due to health concerns. In industries, chloroform found application as a solvent for various substances, particularly in the production of pharmaceuticals, dyes, and resins. Its role in extracting essential oils and flavors from plants, as well as its use as an intermediate in chemical synthesis, contributed to its relevance. However, due to its potential toxicity and environmental risks, its industrial uses have significantly decreased over time in favor of safer alternatives.

Chloroform, a colorless liquid with a distinct sweet odor, has had historical industrial applications. It was used as an anesthetic in medical procedures, although its use for this purpose has largely diminished due to health concerns. In industries, chloroform found application as a solvent for various substances, particularly in the production of pharmaceuticals, dyes, and resins. Its role in extracting essential oils and flavors from plants, as well as its use as an intermediate in chemical synthesis, contributed to its relevance. However, due to its potential toxicity and environmental risks, its industrial uses have significantly decreased over time in favor of safer alternatives. Chlorinated Paraffin plays vital roles across industries. It is integral in fire-resistant PVC compounds, enhancing materials used in wiring, flooring, and upholstery. Moreover, its application extends to the lubricant industry, contributing to improved friction and wear characteristics. These diverse industrial uses highlight its value in enhancing product performance and safety.

Chlorinated Paraffin plays vital roles across industries. It is integral in fire-resistant PVC compounds, enhancing materials used in wiring, flooring, and upholstery. Moreover, its application extends to the lubricant industry, contributing to improved friction and wear characteristics. These diverse industrial uses highlight its value in enhancing product performance and safety. Shoe soles, tyres, and other parts are typically made from butadiene rubber. However, its main usage is in the automobile industry, adhesives, sealants, asphalt, and polymer modification.

Shoe soles, tyres, and other parts are typically made from butadiene rubber. However, its main usage is in the automobile industry, adhesives, sealants, asphalt, and polymer modification. Bleaching earth is a clay substance that is primarily used as an industrial refining material which is used in the purification process of several oil varieties. The clay is an excellent absorber and purifier. It has great bleaching and refining abilities that are used widely at oil refineries. It removes the impurities and cleans the mixture to obtain the product. Impurities may constitute color, proteins, soaps, and unwanted materials in the oil content. The clay is a form of bio-oil used as feedstock. It is also used to produce biofuels, enhancing biodegradable, non-toxic, environmentally friendly commercial alternatives.

Bleaching earth is a clay substance that is primarily used as an industrial refining material which is used in the purification process of several oil varieties. The clay is an excellent absorber and purifier. It has great bleaching and refining abilities that are used widely at oil refineries. It removes the impurities and cleans the mixture to obtain the product. Impurities may constitute color, proteins, soaps, and unwanted materials in the oil content. The clay is a form of bio-oil used as feedstock. It is also used to produce biofuels, enhancing biodegradable, non-toxic, environmentally friendly commercial alternatives.