Bleaching earth is a clay variety that is primarily used in the refining process of oils and fats. It is obtained from the earth and then processed to form a bleaching compound. The clay is formulated with various other clays, namely, bentonite, montmorillonite, attapulgite, and more. It mostly constitutes silica, iron, magnesium, calcium, and aluminium metal.

It is used in various industrial processes in the absorption, bleaching, refining, and filtration processes. It has a variety of color that varies from yellow to pure white. The clay has high absorption abilities and is smooth or greasy in texture. It can be used in its natural state, with its ability to eliminate microorganisms or any impurities to attain the purest form of the chemical process in it.

Request for Real-Time Bleaching earth Prices: https://procurementresource.com/resource-center/bleaching-earth-price-trends/pricerequest

India, Indonesia, and Kenya are the key importing countries that import Bleaching earth. On the other hand, the key exporting countries include India, the United States, and Indonesia.

Key Details About the Bleaching earth Price Trend:

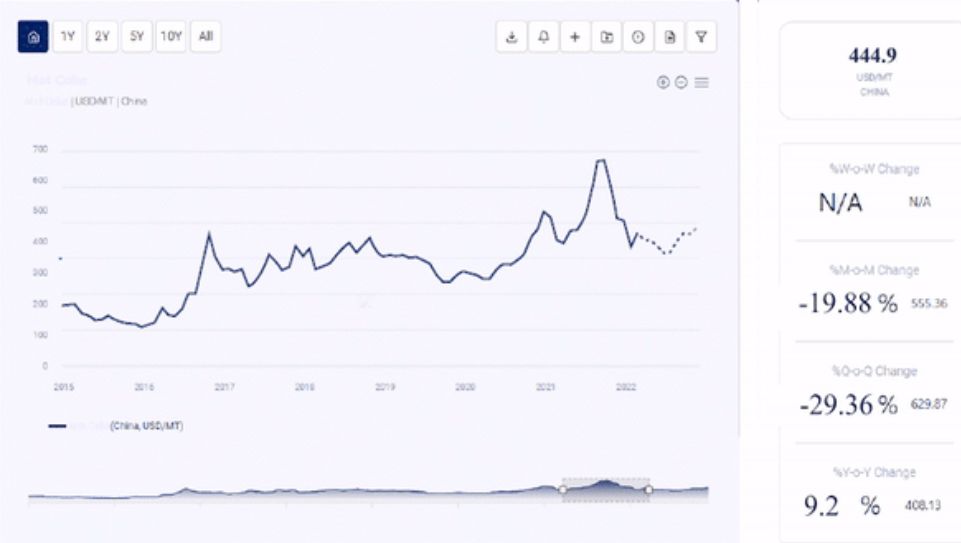

Procurement Resource does an in-depth analysis of the price trend to bring forth the monthly, quarterly, half-yearly, and yearly information on the Bleaching earth price in its latest pricing dashboard. The detailed assessment deeply explores the facts about the product, price change over the weeks, months, and years, key players, industrial uses, and drivers propelling the market and price trends.

Each price record is linked to an easy-to-use graphing device dated back to 2014, which offers a series of functionalities; customization of price currencies and units and downloading of price information as excel files that can be used offline.

The Bleaching earth Price trend, including India Bleaching earth price, USA Bleaching earth price, pricing database, and analysis can prove valuable for procurement managers, directors, and decision-makers to build up their strongly backed-up strategic insights to attain progress and profitability in the business.

Industrial Uses Impacting Bleaching earth Price Trend:

Bleaching earth is a clay substance that is primarily used as an industrial refining material which is used in the purification process of several oil varieties. The clay is an excellent absorber and purifier. It has great bleaching and refining abilities that are used widely at oil refineries. It removes the impurities and cleans the mixture to obtain the product. Impurities may constitute color, proteins, soaps, and unwanted materials in the oil content. The clay is a form of bio-oil used as feedstock. It is also used to produce biofuels, enhancing biodegradable, non-toxic, environmentally friendly commercial alternatives.

Bleaching earth is a clay substance that is primarily used as an industrial refining material which is used in the purification process of several oil varieties. The clay is an excellent absorber and purifier. It has great bleaching and refining abilities that are used widely at oil refineries. It removes the impurities and cleans the mixture to obtain the product. Impurities may constitute color, proteins, soaps, and unwanted materials in the oil content. The clay is a form of bio-oil used as feedstock. It is also used to produce biofuels, enhancing biodegradable, non-toxic, environmentally friendly commercial alternatives.

Key Players:

- Ashapura Perfoclay Limited

- Global Bleach Chem Private Limited

- Oil-Dri Corporation of America

- Taiko Group of Companies

News & Recent Development

- Date: November 1, 2022- The petroleum manufacturer, Shell Eastern, has acquired the EcoOils firm, which is an Asia-based waste oil recycling company. It produces nearly 65000 tonnes of Bleaching earth per year, a variety of biofuel.

About Us:

Procurement Resource offers in-depth research on product pricing and market insights for more than 500 chemicals, commodities, and utilities updated daily, weekly, monthly, and annually. It is a cost-effective, one-stop solution for all your market research requirements, irrespective of which part of the value chain you represent.

We have a team of highly experienced analysts who perform comprehensive research to deliver our clients the newest and most up-to-date market reports, cost models, price analysis, benchmarking, and category insights, which help in streamlining the procurement process for our clientele. Our team tracks the prices and production costs of a wide variety of goods and commodities, hence, providing you with the latest and consistent data.

To get real-time facts and insights to help our customers, we work with a varied range of procurement teams across industries. At Procurement Resource, we support our clients, with up-to-date and pioneering practices in the industry, to understand procurement methods, supply chain, and industry trends, so that they can build strategies to achieve maximum growth.

Contact Us:

Company Name: Procurement Resource

Contact Person: Jolie Alexa

Email: sales@procurementresource.com

Toll-Free Number: USA & Canada – Phone no: +1 307 363 1045 | UK – Phone no: +44 7537 132103 | Asia-Pacific (APAC) – Phone no: +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA